Investing is often not easy and with no guarantee. But for the last four years I have been investing in an asset that has continuously doubled its money after holding for 12 months. That asset is LEGO. Moreover, I’m not alone; many others are also finding success in this unique investment.” as many articles will attest to, many are making their money grow through LEGO investing.

We were written about in the Times recently and it is a story replicated many times.

So what is Lego investing?

I know it sounds ridiculous to some, and to me as well four years ago when I first read about it, buying toys as investments, investments are meant to be saved for boring intangible assets that you never see, not for massive Lego Harry Potter sets or otherwise. But when I looked into it further it was clear how lucrative the opportunity is.

At the very basic level, you buy Lego before it retires from the market, you hold that set in storage, and then due to the age-old tale of any asset ‘supply and demand’ when the demand outweighs the supply, you sell your set for the increased price taking a handsome return on investment.

What do you need to look for a good LEGO investment?

At any one time, there are over 800 Lego sets that are on the market, and the vast majority are often discounted, does that mean any of these are good sets to consider for investment? certainly not. But it is not hard to work out which ones are worth considering. There is a bit more to fine-tune the process as we will explore in upcoming articles, but basically, you are looking for the following.

A popular Theme and set

You want a popular theme – My Favourite Go to themes are. Star wars, Technic, Harry Potter, Marvel and Speed champions.

There is no point investing in a set that is not at all popular, because if it is not popular now then it certainly will not be popular when trying to sell for twice the price.

On the other hand, if your set is hugely popular, then when it stops being built, enthusiasts will still want to pick up these sets, and with less on the market will be prepared to pay a premium for it.

Often certain Lego themes will be ideal for a collectors market. Star Wars, Marvel, and Potter have massive fan bases, making sets in pristine condition well sought after. But it is not just these themes, I have had much joy with City, Friends, Ninjago and most other themes, doubling my money after all the fees on them as well.

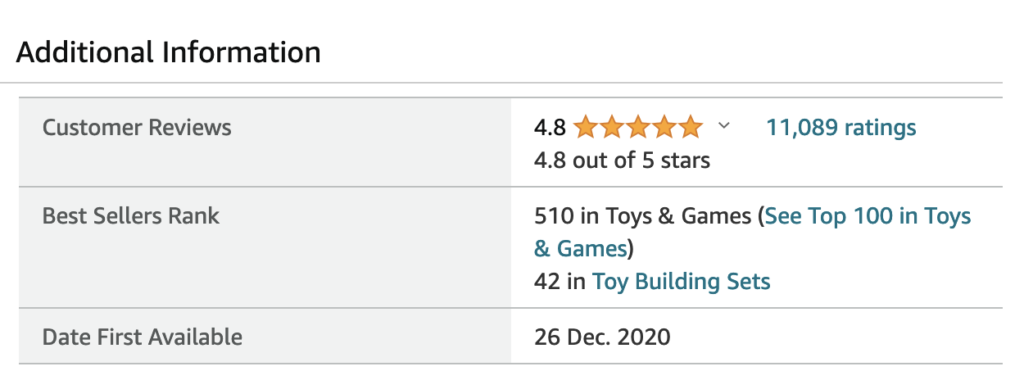

There are a couple of ways to pick out these popular sets, the best way is to check out the BSR (best seller rank) on Amazon to show its popularity. – anything top 10,000 toys and games are well worth consideration, but the popularity of Lego normally means many will be in the 1K -5K range and these are your best sets.

The database also has a regularly updated average 180-day sales rank to help with these considerations

If you are serious about LEGO investing, KEEPA is well worth consideration as it will be regularly updated with all the information you need.

Retiring soon

The most important metric I have learned over the last few years is the need to invest in sets that are close to retiring, there are many good indicators for when sets will retire, Brick Fanatics is a fantastic resource amongst others. As well as our very own database, which will say when the expected retirement date is. I say expected as sometimes they can shift throughout the year. But more often than not they are pretty accurate.

There is no benefit in holding a set that won’t retire for the next few years, and this is the easiest way to tie up your capital, something that I learned to my cost when starting out.

A discount

Lego sets are often discounted regularly throughout the year, and very often you can pick sets up for 40 – 50% off, although this does depend on the sets. To maximise your investment, you will want to pick up these sets when they are discounted. Normally I won’t consider a set for less than 25% discount although there are exceptions to this rule.

But it will be a lot easier to hit that target of a 100% ROI if you have bought at a tasty discount.

Where to sell the LEGO investments?

I normally sell my LEGO products on Amazon through FBA (fulfilled by Amazon) – you need to sign up to get ungated on selling LEGO products, by making a small purchase on a wholesale item of 10 Lego toys, and then you are free to send in your LEGO, the great thing about selling with Amazon is the minimal work that is required to complete it. You send it in, Amazon then deals with all the postage, customer service and returns. When you start looking, the fees are more than eBay, but your LEGO investment will sell for a lot more on Amazon than eBay.

That being said, I still occasionally sell on eBay, usually taking advantage of the low fee offers that they do. It is still possible to make a comfortable return on investment selling through eBay, but I think you will have to work harder for a bit less.

Examples of LEGO investing success

I have many examples of Lego investing successes but let’s put one as an example to show the process

Lego Anakin Jedi Starfighter 75281

This set came out in August 2020 and retired in December 2021. We picked it up in the middle of 2021, at a discounted price of £16 (35% off) – a good discount for Star Wars sets. About 6 months after it retired – I sent it to Amazon and sold it easily for £50 – making a profit of £22.4 after all fees or a return on investment of 140%. Not bad for buying some toys hay? If you look at the price now it is just under £80!

This is by no means an isolated example, off the sets I sold in 2022, The profit margin ranged predominantly from 80-120% profit.

Conclusion

In conclusion, LEGO investing has proven to be a remarkable and lucrative journey for me, doubling my investments consistently over the past four years. While investing is never without risk, the unique dynamics of LEGO’s supply and demand have made it a rewarding venture for many enthusiasts like myself.

As you embark on your LEGO investment journey, remember the core principles we discussed: focus on popular themes, invest in sets close to retirement, look for discounts, and choose collectable sets that stand the test of time.

You can make the process even simpler by getting the support of FBA groups. I am a proud member of the FTF discord group and the resident LEGO investing expert. As well as all advice on getting started, FBA leads, a supportive group and so much more. We also have an almighty LEGO bot, that automatically sends the best deals, but only those deals that will be suitable for investing, taking into account the discount needed, the sales rank and the expiry date.

Join the waitlist to get started and make LEGO investing even easier.

My referral link

I’ll be sharing more insights and tips on LEGO investing in upcoming articles, so stay tuned to uncover new opportunities and strategies.

For more tips on getting into Lego investing and some rules to follow

Check out my ten commandments of Lego investing